Microsoft Dynamics 365 for Financial Services

Dive into the future with D365 for Financial Service Organisations helping streamline operations and drive profits.

Embrace Innovation with D365 for Financial Services

Whether your company is in insurance, asset finance, banking, tax advisory, private equity, or wealth management; a CRM System supports your organisation with effectively managing customer relationships in today’s competitive financial services landscape.

Our Microsoft Dynamics 365 for Financial Services Solution is built at a custom level, ensuring that every feature is tailored to your individual processes enabling you to take your relationships to the next level.

Benefits of Dynamics 365 for Financial Services

Key Features of Dynamics 365 for Financial Services

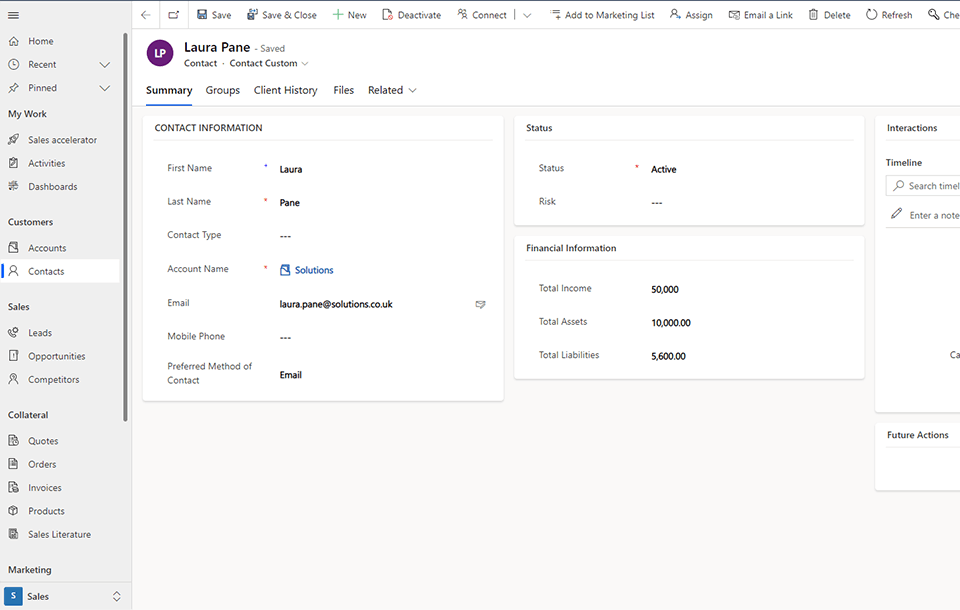

Contact & Account Management

Effortlessly manage essential details regarding your contacts and accounts by implementing our Financial Services CRM. Customised to your organisational needs, the information displayed can vary but may cover information such as contact information, financial history, client interactions, notes, and much more, ensuring seamless management of your data.

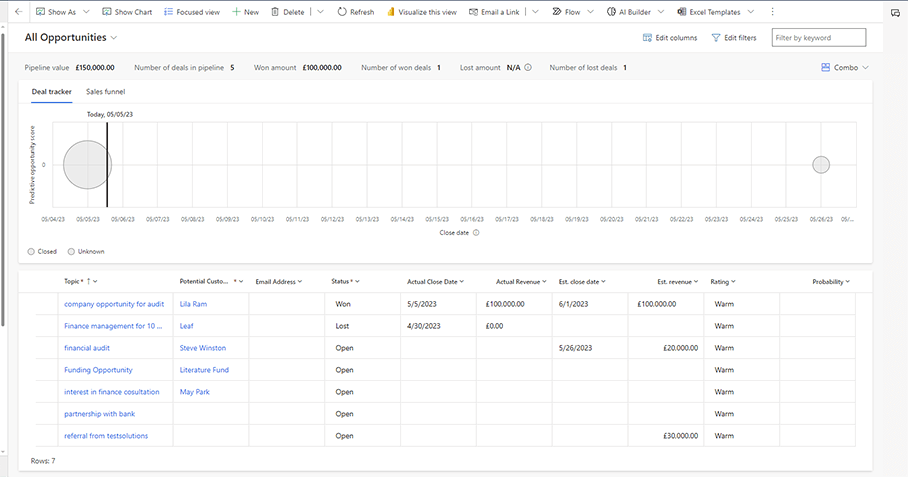

Lead & Opportunity Management

Easily track the progress of your leads and opportunities, identifying those ready to convert and ones that still need further attention. This ensures that your pipeline is managed effectively driving sales and overall profit.

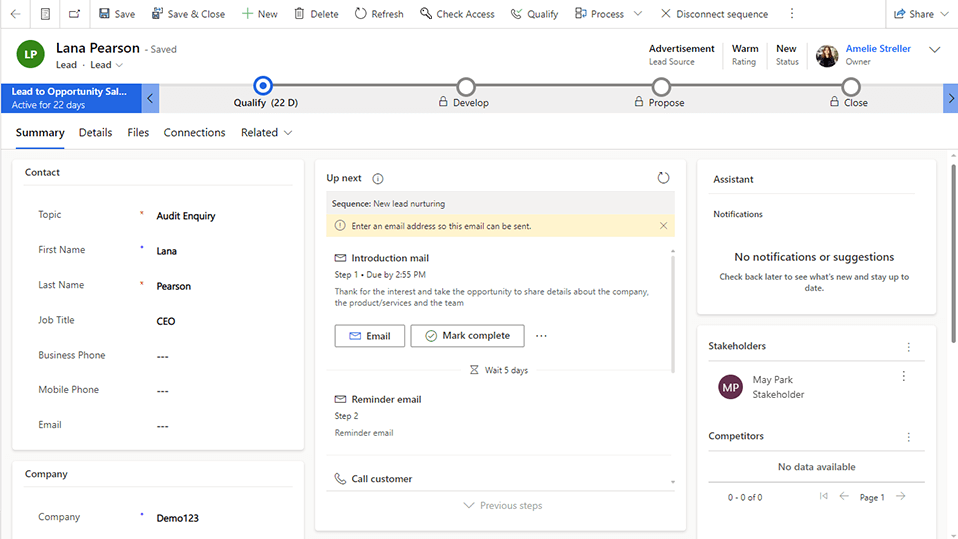

Workflow Automation

Manual processes can hinder efficiency and take up valuable time that could be spent better elsewhere. D365 for Financial Service Organisations offers advanced automation capabilities, streamlining processes and reducing manual tasks.

Advanced Marketing Capabilities

Communicating with potential and current customers, at the right time, through the right channel, and using the right content is crucial for providing a positive customer experience. Our Finance CRM has a wide variety of marketing capabilities that make personalisation and engagement easy.

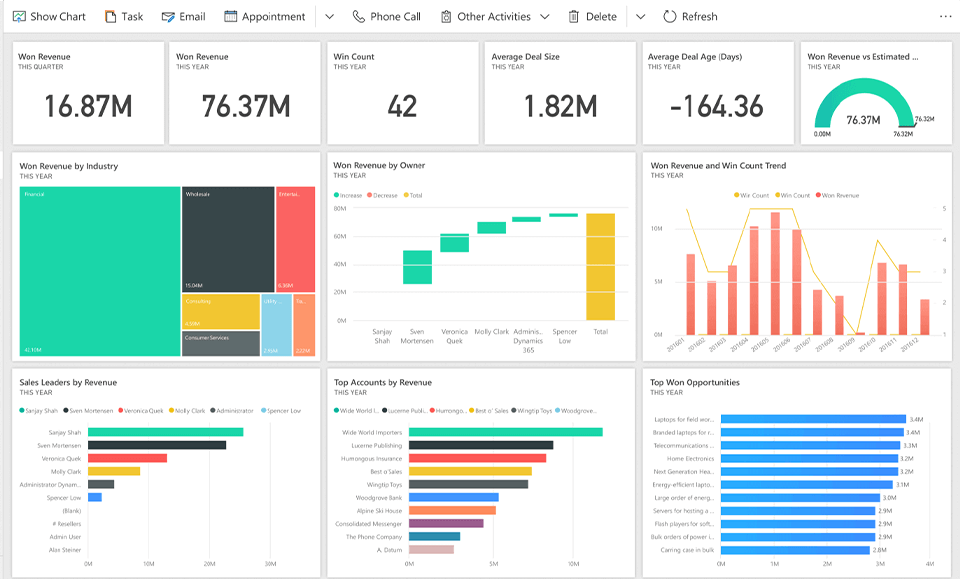

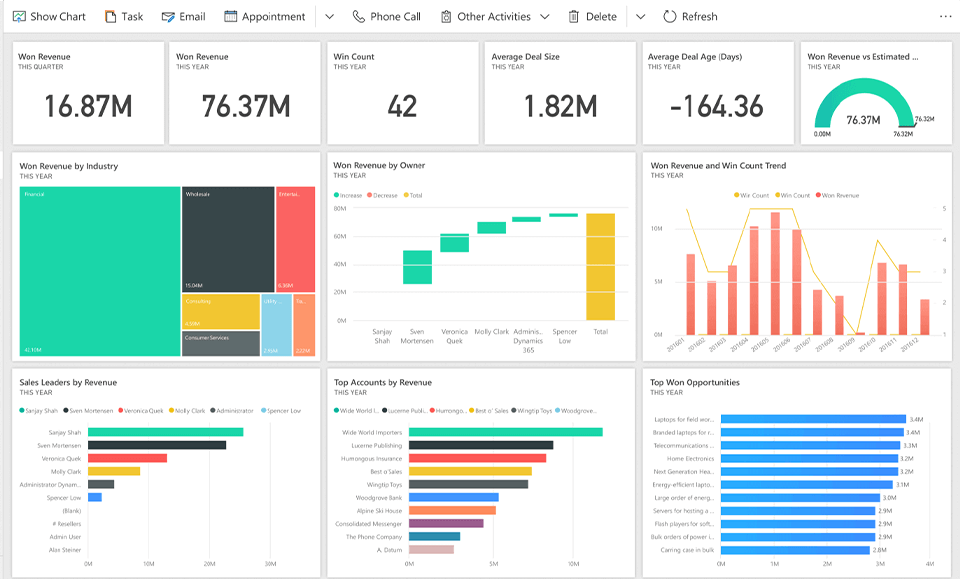

Analytics and Reporting

Our solution provides in-depth insights into your projects, sales pipeline, financial figures, campaigns, and more, providing stakeholders with a clear understanding of activities, problem areas, resource distribution and more.

Security and Compliance

Financial services organisations must follow strict legislation within the industry and ensure that they remain compliant in everything they do. Microsoft has a comprehensive security and compliance model means that your data is safe and secure.

Moreover, secure credentials coupled with specific security roles, ensure that users can only access the information that they need.

Third-party Integrations

Dynamics 365 seamlessly integrated with the Microsoft 365 Suite (Sharepoint, Excel, Word, etc.), the Power Platform (Power BI, Power Automate, etc.), Business Central and various applications such as Sage and Zero.

Insurance and Asset Finance CRM

Want to know about our bespoke offerings in the financial services industry? Take a look at our specific pages below for more information, and if you don’t see your industry please get in touch.

Insurance CRM

Our CRM for Insurance Brokers centralises information, promoting effective client relationship management, increased engagement across clients and brokers, while also having the capability to monitor policies, claims, premiums, renewals and more.

Asset Finance CRM

Built specifically for asset finance, our cloud-based CRM software enables your business to spend less time on administrative tasks and more time focusing on client relationships.

Frequently Asked Questions

No, our solution is built on Dynamics 365, but is a bespoke solution that is tailored to your specific needs and requirements. The above features are only an example of what your system could look like.

At Pragmatiq we have developed our implementation methodology to be the perfect pairing to the technology we offer. Our approach follows several stages, each of which is designed to ensure the successful delivery of your solution.

We understand that over time, your organisation will grow and change, and your needs may shift; the beauty of a bespoke solution is that it can be tailored even after implementation.

At Pragmatiq, we have a Managed Service offering, which allows us to support your business post-go-live.

At Pragmatiq, we have several factors that set us apart and ensure we are the best fit to support your business:

A consultative focus

Initially taking the technology out of the conversation, we work closely with you and your training business to understand processes, challenges and future goals. From this, we are able to advise you on the right solution that is tailored to your specific requirements. The customer’s business model is always our starting point and we are uncompromising in our approach to be more than just a ‘technology company’.

We are passionate and we care

We are passionate about what we do and head into work every day excited about working with our customers and what we can achieve. We recognise if you like what you do, you will do it better and deliver to a higher standard.

Simple language

Often IT resources cannot translate ‘technical jargon’ which is a common barrier. Our consultants are not only technically capable, but are able to identify business challenges and explain how they can be solved in simple language.

Want to keep in touch?

Sign up to our newsletter for regular updates.

"*" indicates required fields

Speak to an expert today

Please complete the form below and a member of our team will get back to you shortly.

"*" indicates required fields